Salary expense without insurance contribution as deductible expense?

Enterprise sign Labour contract under the term from over 3 months must contribute insurance for employees. So that, in case, Enterprise does not contribute insurance for employees, is Salary expense without insurance contribution recognised as a deductible expense in caculating CIT ? We would like to discuss about the matter to the following:

Legal basis for Salary expense without insurance contribution

According to Circular 78/2014/TT-BTC, Article 6, clause 1 regulates deductible expense as below:

“1. Except expenses specified in Clause 2 of this Article, enterprises may deduct all expenses that fully satisfy the following conditions:

a/ Actual expenses arising in relation to production and business activities of enterprises;

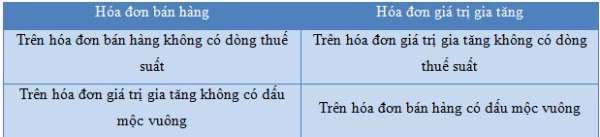

b/ Expenses with adequate lawful invoices and documents as required by law;

c/ For expenses for purchase of goods or services with invoices valued at VND 20 million or more (VAT-inclusive prices) each, there must be non- cash payment documents;

Non-cash payment documents must comply with legal documents on value-added tax;.”

Based on above regulation, in order salary expense can be classified as deductible expense, requested:

– Salary expenses to staff is for purpose of the operation of the Enterprise.

– With enough documents such as:

+ Labour contract

+ Wages and bonuses regulation.

+ Collective labour agreement (if any)

+ Salary increase decision (in case salary increase)

+ Monthly timesheet.

+ Salary payment sheet.

+ Salary payment evidence.

However, in some cases, salary expense can’t not be classified as deductible expense as regulated in Circular 78/2014/TT-BTC, Article 6, Clause 2, Point 2.5 below:

– Salaries, wages and other amounts payable to employees that enterprises have accounted as production and business expenses in the period but have not made such payments or have no payment documents as required by law;

– Salaries and bonuses for employees for which the conditions for entitlement and rates of entitlement are not specified in one of the following dossiers: labor contract; collective labor agreement; financial regulations of the company, corporation or group; reward regulations issued by the chairman of the Board of Directors, general director or director under the financial regulations of the company or corporation;

– Salaries, wages and allowances payable to labourers that enterprises have not yet paid by the deadline for submission of annual tax finalization dossiers, unless enterprises have a provision fund to supplement the wage fund of the subsequent year. The annual level of provision is decided by enterprises but must not exceed 17% of the implemented wage fund; (Actual wages fund for the year).

– Salaries and wages of owners of private enterprises or single-member limited liability companies (owned by an individual); remuneration paid to the founding members, members of the Members’ Council or Board of Directors who are not directly involved in directing production and business.

Conclusion:

Thus, regulation on salary expense as deductible or non-deductible expense: At the moment, we do not have any writing documents regulating that Enterprise without social insurance contribution then salary expense can’t classified as deductible expense.

– About insurance law: If Enterprise did not contribute insurance for staffs, Enterprise will be penalized for late payment and have to paid all insurance liability to date when this case being recognized by Insurance department.

– About CIT Law, Under current CIT Law, salary expenses with enough documents as regulated by Law can be classified as deductible expense..

Reference: General department of Tax had issued official letter no 3884/TCT-CS dated 18/11/2013 instruction about salary expense without social contribution for corporate income tax purpose. According to above official letter, wages, salaries, bonuses expense which is paid to employees, that is directly related to the operation of the enterprise with enough invoice, legal documents and not belonging to items listed in point 2.5, clause 2, article 6 Circular 123/2012/TT-BTC dated 27/7/2012 issued by Ministry of finance then these expenses can be classified as deductible expense for CIT purpose. In case, Enterprise violates regulations of social insurance contribution, these violation will be handled by Social insurance Law.